Maharashtra loan waiver: Day after Fadnavis’ reassurance about fixing mistakes, MLA Prakash Abitkar erroneously gets Rs 25,000

Nagpur: Maharashtra chief minister Devendra Fadnavis told the state legislative Assembly on Thursday that his government had made some “mistakes” while implementing the Rs 34,022 crore farm loan waiver scheme, but has rectified all these issues.

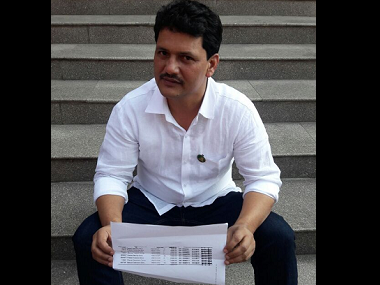

It hasn’t been 24 hours since Fadnavis’ statement, and already cracks are beginning to appear in his claim. Prakash Abitkar, Shiv Sena MLA from Radhanagari in Kolhapur district, claimed on Friday that he has received Rs 25,000 even though he hadn’t applied for the loan waiver. Abitkar said he has become the latest beneficiary of the state government’s Chhatrapati Shivaji Maharaj Shetkari Sanmaj Yojana (CSMSSY) though MLAs are supposed to be exempt.

Abitkar’s revelations raise doubts over Fadnavis’ assurance that the CSMSSY would be in place till the “last eligible farmer is included”. Under the provisions of the scheme, loans of up to Rs 1.50 lakh will be waived by the government, while farmers who repay their loans regularly will get rebates of up to Rs 25,000 as incentive. The scheme was announced on 24 June and was initially meant to be rolled out before Diwali. But a series of technical errors, fudging of data by banks, duplication of Aadhaar card data and account number duplications meant the scheme is still stuck in limbo, nearly six months since inception.

“Under the scheme’s provisions, corporators, MLAs, MPs and members of zilla parishads are not eligible the loan waiver scheme. This is what a GR issued on 28 June said,” claimed Abitkar, who demanded to know how did he become a beneficiary. “I never applied for the loan waiver or any of its incentives. There needs to be a detailed inquiry into this. In fact, it’s not only me alone, but also teachers, retired school principals and Class II officers of the MSEB who have been named in the list. Farmers’ names have come up without anybody bothering to check the list. I will unearth this scam and expose it,” he said.

In the last one month, the Kolhapur District Central Cooperative Bank received 78,000 applications for the loan waiver scheme. But after Fadnavis’ reply in the Assembly, 80,000 new applicants have sent their names to Kolhapur district authority. “How did the IT department and banks cross-check 80,000 accounts in one day? Something is clearly wrong, and most of the farmers are ghost beneficiaries,” Abitkar alleged.

The others mentioned by Abitkar include Deepak Mahadev More and Bhimrao Tukaram Shinde, who are local teachers, Prakash Pandurang Bhat, an MESB Class II officer, and retired principal Pandurang Dandev Parit.

Abitkar confirmed that his account number in Kolhapur’s KDCC bank is 954972, and he is a beneficiary of the government’s scheme.

Criteria for CSMSSY

The government notification published on 28 June said one of the key criteria will be the definition of a family: It will be defined as a unit comprising a husband, a wife and their minor children. But this was later amended to extend loan waiver to one member per family. Only one outstanding loan would be repaid per family, it said. However, if the husband and wife have separate accounts and both have outstanding loans against their names, the wife’s loan would be considered priority for a waiver, the GR said. It also mentioned that land holdings wouldn’t be considered while benefits are given out.

People paying tax for income from non-agriculture sources also wouldn’t be included. Furthermore, government, semi-government and government-aided employees (except Class IV workers) wouldn’t be considered for the loan waiver. People with gross income of over Rs 3 lakh and are registered to pay service tax are also not eligible. Similarly, people registered to pay VAT and service tax, or those with a turnover of more than Rs 10 lakh from businesses other than agriculture can’t apply for the waiver scheme. The upper limit for CSMSSY was capped at Rs 1.5 lakh, which has now been increased.

On the other hand, the clause which debarred people who own four-wheelers from applying had been done away with. Pensioners who earn over Rs 15,000 per month — except army jawans — will not be considered. Chairman and deputy chairman of cooperative societies like milk societies, district banks, or chairman of the APMC markets across the state would also not be included. However, members and directors of these cooperatives will be allowed to avail of the scheme’s benefits, the GR said.

What is CSMSSY?

The state government’s ambitious loan waiver scheme had initially targeted nearly 89 lakhs farmers, a majority of whom would be covered entirely, their outstanding loans of up to Rs 1.5 lakh be waived off completely. The government had also announced concessions to be given to farmers who have been regularly repaying their loans. However, in order to be eligible, these farmers need to pay loans for the years 2015-16 and 2016-17 before a 30 June deadline, to be eligible for the maximum available concession of Rs 25,000.

An online platform, Aaple Sarkar, was developed to decide details of disbursement methods, and a Cabinet sub-committee was formed to deal with glitches during the execution period. The state government also passed a Rs 20,000 crore supplementary demand provisions for the scheme in the Monsoon Session of legislative Assembly in August, and a Rs 15,000 crore supplementary demand provision in the Winter Session in December.

http://www.firstpost.com/india/maharashtra-loan-waiver-day-after-fadnavis-reassurance-about-fixing-mistakes-mla-prakash-abitkar-erroneously-gets-rs-25000-4259987.html

Leave a Reply