Category UID

With protests under constant surveillance, Modi’s massive facial recognition system is making it easier to crack down on minorities and political opponents. Aparajita Ghosh October 14, 2022 Embed from Getty Imageshttps://embed.gettyimages.com/embed/1240716221?et=Csz0Q8oESz1ko_KYhhrZFQ&tld=com&sig=nu-zyFiP4WNB2j0TRLCLUUK_rq2VXSWFxnYmfZCTnXU=&caption=true&ver=2 A few months after Narendra Modi was re-elected in… Continue Reading →

Ghosh said he tried to contact the UIDAI officials, asking for a formal letter with a list of the objections, but there was no response Updated At: Jul 25, 2021 03:03 PM (IST) Mumbai, July 25 The Unique Identification Authority of India… Continue Reading →

Ram Kumar Das, priest of Ram-Janki Virajman Mandir, was allegedly asked by a govt official to get a card in the name of lord Ram to sell wheat he grows on temple land Mahant Ram Kumar Das had all the… Continue Reading →

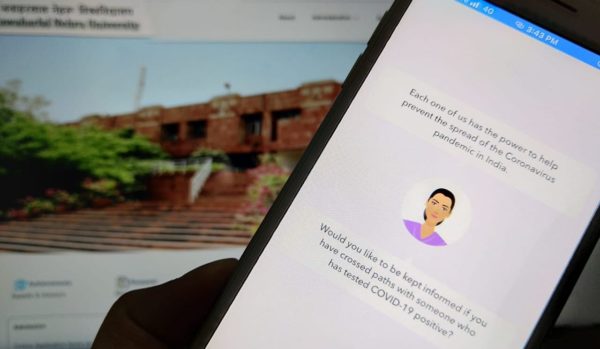

Aarogya Setu’s developers have made the entire list of contributors public on GitHub, along with source code of the Android version of the app. It includes government and industry/academia “leaders”, many of whom had come out in the public for their involvement… Continue Reading →

S.R. PraveenTHIRUVANANTHAPURAM:, SEPTEMBER 29, 2020 Representational photo. Activists say it is against Supreme Court judgment The petitioners in the Puttaswamy case that challenged the constitutionality of Aadhaar in the Supreme Court have sent a legal notice to the State government… Continue Reading →

Furquan Moharkan, DHNS, New Delhi, SEP 29 2020, 01:04 IST The three tech majors — Wipro, IBM and Dell — in various letters to the CVC and UIDAI, have raised objections to the participation of HP-Enterprise in the bidding process. Credit: iStock…. Continue Reading →

Karnataka HC to hear plea on mandatory use of app for interim relief “The Court is not concerned whether Aarogya Setu app is good or bad…The issue at this stage is whether State…can make downloading of Aarogya Setu app mandatory”,… Continue Reading →

Given that the updation of the National Population Register (NPR) is scheduled to begin from April 1, 2020 along with house listing for the Census of India 2021, prominent women rights activists, including Annie Raja, Farah Naqvi, Anjali Bhardwaj, Vani Subramanian,… Continue Reading →

Documents obtained under RTI show the govt is planning to use Aadhaar to automatically track every single Indian – from who they marry, address changes, financial status – through the National Social Registry. By Kumar Sambhav Shrivastava NEW DELHI — The Narendra… Continue Reading →

Fema Rules Tweak To Help Select Minorities, Excluding Muslims Rachel Chitra & Partha Sinha TNN Bengaluru/Mumbai: Soon, banks may introduce a new column in ‘know your customer’ (KYC) forms for their depositors and clients to mention their religion. This requirement… Continue Reading →